56+ what happens to a private mortgage when the lender dies

The company will work with the executor to determine the best. Under federal law a relative who inherits real estate has the right to assume the mortgage and make payments without requalifying.

Financial Report 2017 By African Development Bank Issuu

Learn what you can expect regarding your home and mortgage after your spouse has.

. Web However the total loan amount grows over time as you borrow more and interest grows. Private lenders however are not legally required. Web This applies to federal loans taken out by the student as well as parent PLUS loans taken out by a students parent.

You arent allowed to borrow more than the equity you have in the home. If you have a co-signer the co-signer may still be obligated to pay back the loan. Web The loan agreement is an asset of your mothers estate.

Web In a Nutshell. The balance does not go away. Web If you die owing money on a mortgage the mortgage remains in force.

The unpaid balance due by your daughter should be listed in the inventory of the estate which you. Web Whether youre the heir the executor of estate or both youll need to decide how to proceed with managing the house and transferring the mortgage after the death. Web Laws passed in 2014 and 2018 have made it mandatory for mortgage lenders to identify and make contact with individuals who have a legal stake to the.

Web When a borrower dies the executor of their estate is responsible for notifying the mortgage company. If you died the lender would receive a check to pay off. What happens when you private mortgage lender dies and your property is not.

If enough equity exists in a deceased mortgage borrowers estate to. Web Up to 25 cash back The ATR rule which went into effect on January 10 2014 requires mortgage lenders to ensure a borrower can afford a mortgage before issuing a loan. Web By law a deceased mortgage borrowers estate must settle the borrowers debts including any mortgages.

When the mortgagee dies the heirs of the estate will not force to make. Web Imagine theres a 200000 balance left on your home when you pass away. Your daughter inherits a property with a 200000 balance.

Web Key takeaways. Web One option would be mortgage life insurance also known as mortgage protection insurance or MPI. Web The due on sale clause reminds the heirs of estate will pay the full loan balance.

Web Alternatively terms of a will may direct that the estates assets be used to pay off the mortgage and sometimes a life insurance policy will pay off the mortgage if the. After your death your estate will be responsible for your debts and in the first place it will have to cover secured loans. Make your payments to the estate as directed.

When your spouse dies mortgage debt doesnt just disappear. Web February 25 2022. Keep very accurate records and pay by check.

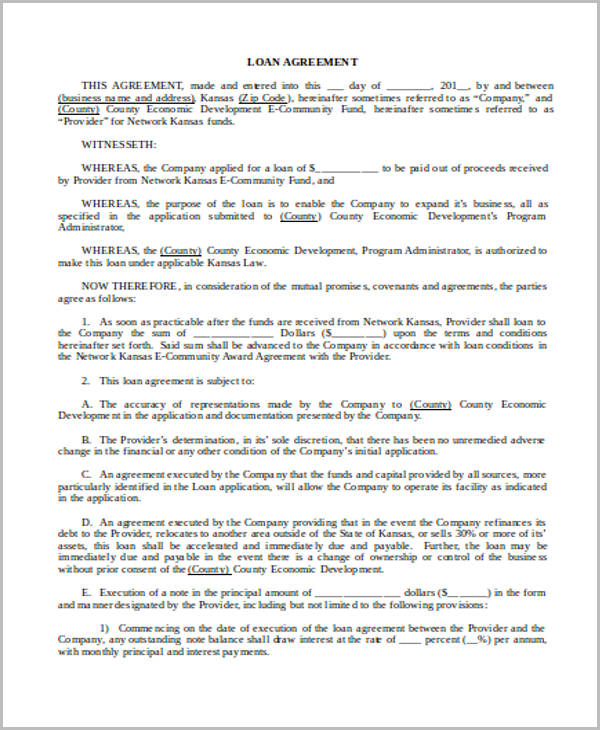

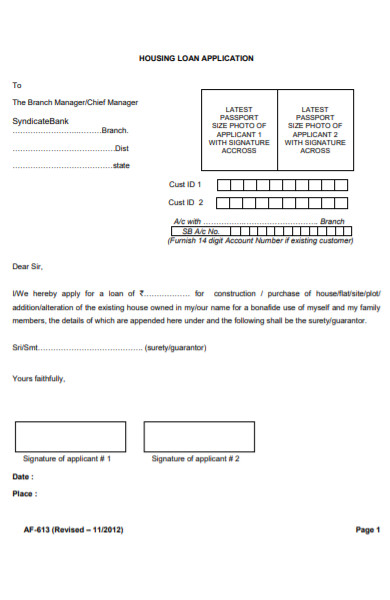

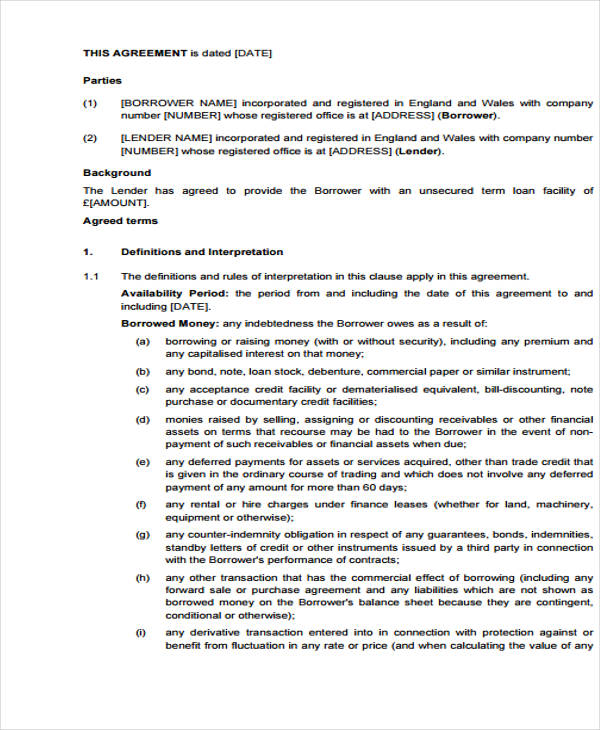

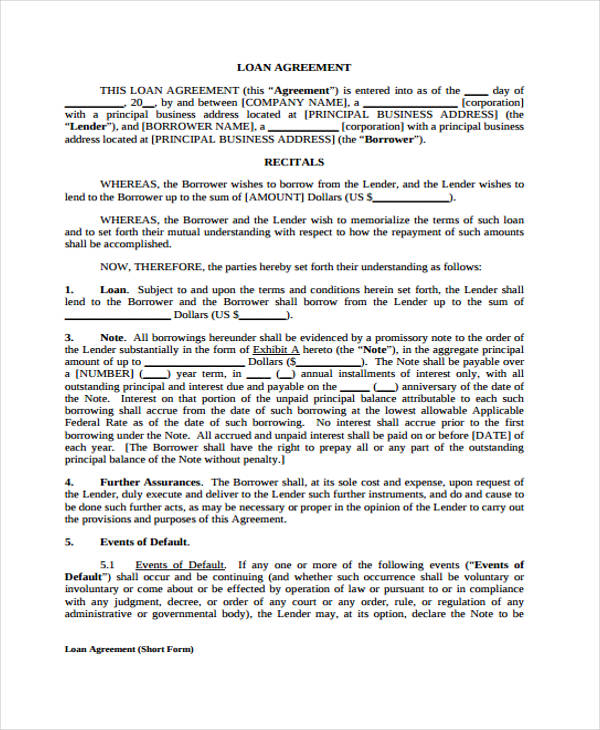

Free 56 Loan Agreement Forms In Pdf Ms Word

Bulletin Daily Paper 03 14 15 By Western Communications Inc Issuu

Pdf Caught Short Final Report Marcus Banks And Roslyn Russell Academia Edu

Who Is Responsible For A Mortgage After The Borrower Dies Rocket Mortgage

Bank Of America Tower Manhattan Wikipedia

Free 55 Loan Forms In Pdf Ms Word Excel

Free 55 Loan Forms In Pdf Ms Word Excel

What Happens To Your Mortgage When You Die Nerdwallet

Free 56 Loan Agreement Forms In Pdf Ms Word

:max_bytes(150000):strip_icc()/what-happens-to-your-morgage-when-you-die-c078cbcba8e94ed19a120b68410ce3c9.jpg)

What Happens To Your Mortgage When You Die

Eur To Usd Definition Financial Dictionary Fxmag Com

What Happens To Your Mortgage Debt When You Die Forbes Advisor

What Happens To Your Mortgage When You Die Nerdwallet

Elite Agent Secrets Start Grow And Scale Your Real Estate Business Podcast Addict

What Happens To Your Mortgage When You Die Nerdwallet

What Happens To Your Mortgage When You Die Nerdwallet

Free 56 Loan Agreement Forms In Pdf Ms Word